Written by Ryan McGuine //

Every summer, BP releases its annual benchmark publication, the Statistical Review of World Energy, which details trends in energy production and consumption over the course of the previous year. The report is backward-looking, so this year’s report does not include data reflecting the impacts of Russia’s cruel war of choice against Ukraine. Interested readers can see summaries of past Statistical Reviews for comparison.

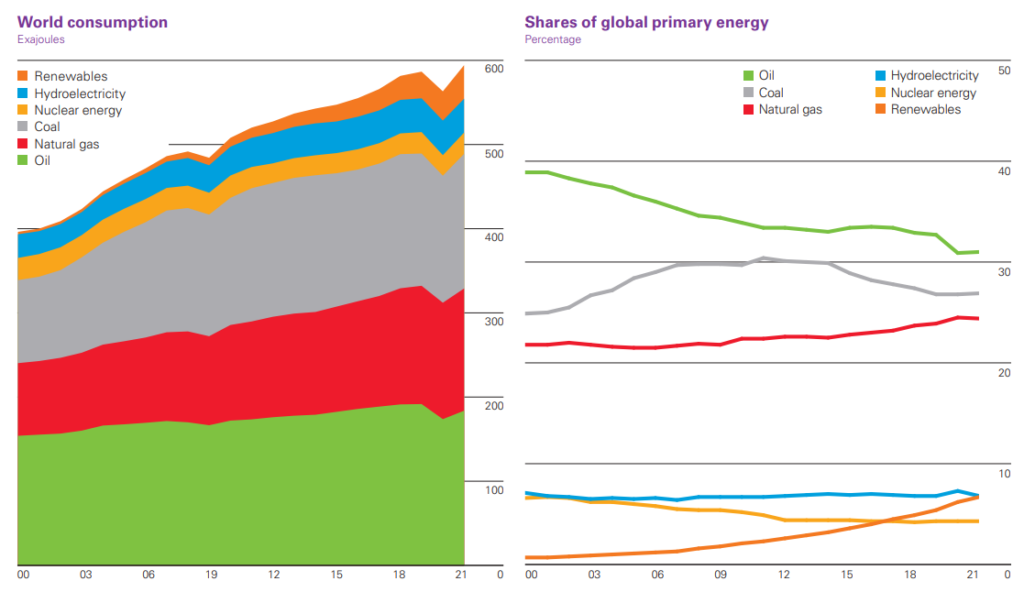

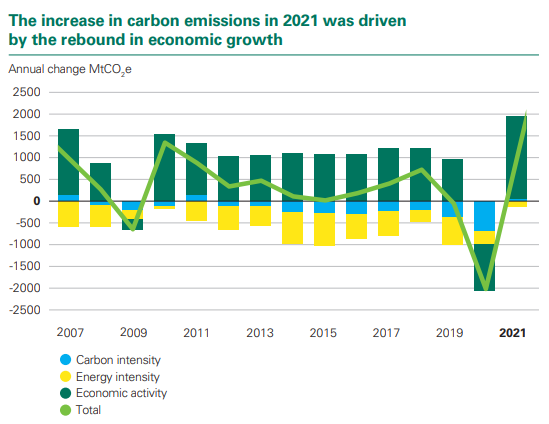

Today’s energy mix is dramatically different than it was just a decade ago, and even more so the further back one goes. However, most years are fairly similar from one to the next — carbon emissions and energy usage might change in one direction or another by a few percent, determined largely by economic growth, energy prices, and the number of unusually hot and cold days. However, primary energy demand saw its largest single-year increase in 2021, rising by 5.8% to surpass 2019 levels by 1.3%. The increase in primary energy consumption was driven by China, which has increased consumption by 15 exajoules (EJ) since 2019, and was dominated by renewable energy. While these jumps are massive by historical standards, it is important to consider the year in relation to 2020, during which carbon emissions and primary energy consumption both saw their largest single-year reductions since 1945. Rather than indicating a new normal, then, 2021 represents a rebound to something like the pre-pandemic normal.

Last year was a mixed bag in terms of the transition toward lower-carbon sources of energy. The bad news is that carbon emissions grew a lot during 2021, increasing by 5.7%. That continues a trend of global carbon emissions rising every year since the signing of the Paris Agreement (excepting 2020, due to pandemic lockdowns). In fact, if one smooths over the pandemic’s impacts on energy usage, carbon emissions have barely changed since 2019. As a percentage of global primary energy use, fossil fuels accounted for 82% of primary energy use last year, down slightly from 83% in 2019 and 85% five years ago. Unfortunately, since total energy consumption has gone up, total fossil fuel consumption has remained relatively flat for the last three years. This flatlining may suggest that 2021 is peak fossil fuel consumption, but it it is still too early to say, and fossil fuel use needs to be declining annually to reach existing net-zero targets. In better news, renewables posted a banner year, increasing by 15%, which was faster growth than any other source.

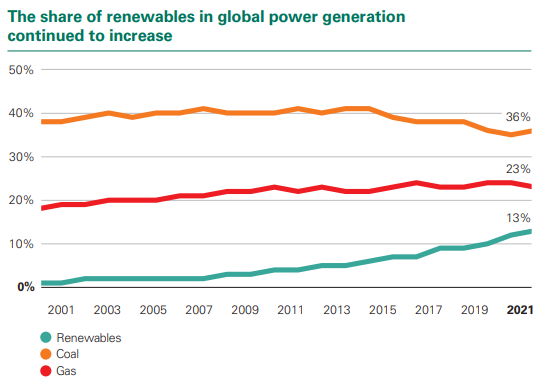

The power sector, the largest single market for primary energy, and the leading source of greenhouse gas emissions in most countries, rebounded strongly after COVID-related declines in 2020. Power consumption grew by 6.2% in 2021 as the world returned to in-person work and school. Renewables (which BP counts as biofuels, plus electricity from sources other than coal, natural gas, nuclear, or hydro) accounted for 13% of the global power mix, with wind and solar alone generating 10.2% of the world’s electricity, surpassing nuclear for the first time. Speaking of nuclear power, it grew by 4.2% in 2021, the largest increase since 2004, thanks mainly to new additions in China. Coal grew from 35.1% to 36% of global power generation, remaining the world’s top generation source. While natural gas increased by 2.6%, strong growth by other sources meant that its share shrunk from 23.7% to 22.9%. The growth of renewables in power generation is particularly important because decarbonizing electricity makes it possible to make many other processes low-carbon by electrifying them.

Renewables grew by 15% in 2021, more than any other source of primary energy. Solar and wind together grew by 226 gigawatts (GW), just lower than its 2020 additions of 236 GW. Once again, China led capacity growth. The country added 289 terawatt-hours (TWh) of renewable power generation, roughly the entire electricity consumption of Britain, accounting for 36% of global solar additions and 40% of wind additions. Zooming out, renewables grew by an average of 15% per year over the past decade, enough to offset the average annual primary energy demand growth of 1% over that time, thanks mainly to impressive cost declines. However, with the exception of biofuels, renewables are used almost exclusively for power generation. Since electricity cannot easily substitute for every application that fossil fuels are currently used for, economy-wide decarbonization is necessarily an exercise in “both-and thinking” — achieving net-zero targets is impossible without continued rapid renewables deployment, but technologies like hydrogen, sustainable jet fuel, energy efficiency, and carbon capture will all have roles to play as well.

Coal consumption grew by over 6% in 2021 to 160 EJ, its highest levels since 2014. China and India together accounted for over 70% of global coal demand growth, but growth was also strong in Indonesia. Both America and Europe also increased consumption after nearly a decade of declines. Global production grew at a similar clip, by 440 megatonnes (Mt), led by China and India. Despite a small growth in coal consumption this year, the past decade has been mostly flat for global coal consumption – impressive after explosive growth during the early 2000s, but disappointing to see at a time when consumption urgently needs to be decreasing. The vast majority of coal consumed is “thermal coal,” which gets burned for power generation. A smaller fraction of coal is “metallurgical coal,” which is harder, blacker, and more carbon-rich than thermal coal, and gets turned into coke to produce steel.

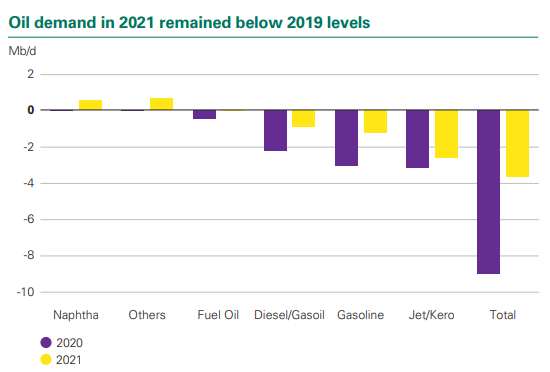

Like all other sources of primary energy, oil consumption saw strong growth in 2021. It increased by 5.3m barrels per day (b/d), but remained below its 2019 levels. In 2021, most demand came from gasoline and diesel, which was regionally driven by America, China, and Europe. Global oil production grew by 1.4m b/d in 2021, with over three-quarters of the growth coming from OPEC+ countries, the 13 OPEC members and an informal group of other large producers. Libya, Iran, and Canada led the way in production increases, while Nigeria, Angola, and Britain clocked the largest declines. Refinery capacity declined by nearly 500,000 b/d to its lowest level since 1998, its first year-over-year fall in over 30 years. This was driven by sharp declines within the OECD, a club of 38 mostly-rich countries, where capacity fell by over 1.1m b/d. Crude oil is removed from the ground and refined into a range of petroleum products, including a range of fuels and industrial feedstocks for chemicals, plastics, and asphalt.

Natural gas use grew by 5.3% to surpass 2019 levels, but maintained a constant share of total primary energy consumption, at 24% of all energy used. A gas at ambient conditions, natural gas is most easily transported via pipeline. Russian pipeline exports to Europe remained constant, around 167 bcm, while pipeline exports from Algeria and Azerbaijan to Europe grew by 13 bcm and 6 bcm respectively. Natural gas can also be moved between continents on ships in liquid form. This requires energy-intensive processes of liquefaction and regasification. Supply of liquefied natural gas (LNG) grew by 5.6%, or 26 billion cubic meters (bcm), to 516 bcm. Nearly all of the growth occurred in America, where several major liquefaction construction projects are nearing completion. Meanwhile, most LNG demand growth came from China, which surpassed both Japan and Europe as the world’s largest importer for the first time in 2021. Natural gas is commonly used in combustion turbines to generate electricity, burned for space heating, or burned for high-temperature heat in industrial applications.

Lithium production rose sharply in 2021, jumping 27%, while cobalt production rose just 4%. Mineral prices have continued to rise for a few years due to sustained demand surpassing supply, leading some to worry about their long-term supply. However, there is little to worry about. The report suggests a 191 year reserves-to-production (R/P) ratio for lithium, 298 years for graphite, and 433 years for rare earth elements. While it notes a 52 year supply of cobalt, R/P ratios typically go up over time. These minerals are crucial to the energy transition – cobalt and lithium are used in batteries for EVs and grid-scale electricity storage, silicon is used in solar panels, and rare earth metals are used in magnets for wind turbines. Thus, it is worth remembering that resource extraction will still play a key role in a world that consumes less fossil fuels.

Among the things that remained consistent in 2021 was China’s status as an outlier by nearly any measure. Sometimes held up as an example of a country taking climate change seriously, other times used as an excuse not to reduce emissions, China is best understood as a country determined to install as much energy infrastructure as it can, as quickly as possible. Similar to its foreign development initiatives, where it has focused on hard infrastructure, in contrast to the West’s promotion of health and democracy, China is more concerned with physical wins than intangible goodwill on climate. It has largely avoided signing strict emissions reduction targets – China’s leaders view such agreements as unfair since the country has lower per capita emissions and lower incomes than many Western nations – opting instead to promote the growth of domestic clean energy industries to erode the dominance of foreign companies.

Another consistency from past years is a large and growing divergence between climate rhetoric and action. While the last decade has consisted of back-to-back record years for renewables, fossil fuel use has remained flat for the last three years. Historically, energy transitions have moved slowly and consisted of adding additional resources to the energy mix, rather than replacing existing resources. In that respect, the current energy transition is panning out similar to past ones. However, the mathematics of climate change demands actually reducing consumption of existing resources at the same time as ramping up deployment of new ones – something that has never been done before. Fortunately, some countries have already decoupled greenhouse gas emissions and incomes by making structural changes to the way humans already live. Unfortunately, this remains far from a global reality.